March 4, 2026

For Active Reservists and National Guard Differential Pay, At Last

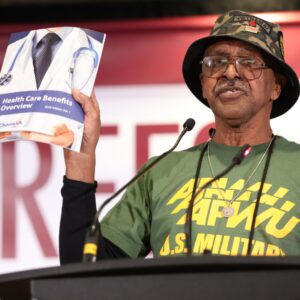

(This article by then-Executive Vice President Cliff Guffey appeared in the May/June 2010 issue of The American Postal Worker magazine.)

In February, the Postal Service notified the APWU that it was finally ready to comply with its obligation to grant “differential pay” to employees who have been called to active duty since March 14, 2009.

In accordance with federal law (5 U.S.C. §5538), the USPS must pay eligible employees the difference between the amount of “pay and allowances” they received from the Department of Defense and their “basic pay” from the Postal Service for covered periods. These payments must be equal to the amount by which an employee’s projected civilian “basic pay” for a covered pay period exceeds the employee’s actual military pay and allowances for that pay period.

In a Feb. 4 letter to the union, the USPS announced that they will begin notifying eligible postal employees who have been on active military duty that they qualify for the reservist differential wages. Qualifying employees must be members of the Reserve or National Guard.

If you were called or served on active military duty on or after March 14, 2009, you should have received a letter from the Postal Service notifying you that you may be eligible, and informing you that, “The differential is payable for Leave Without Pay (LWOP) hours only and is adjusted for any civilian basic pay received (work hours, paid leave, or other paid time off) during a qualifying pay period.”

The letter also should have instructed you to submit to the Human Resources Shared Service Center (HRSSC):

- Your qualifying orders

- All of your military Leave and Earning Statements (LES). Equivalent documents from the Defense Finance and Accounting Service or the Department of Homeland Security are also acceptable.

Employees who believe they may be eligible for this payment or may become eligible in the future should send these documents to:

USPS HR Shared Service Center

Attn: Reservist Differential

PO Box 970400

Greensboro, NC 27297-0400

Once the HRSSC has received the above documents, personnel will validate an employee’s eligibility based on a review of the qualifying orders provided, and the LES will be calculated for payment of the differential. The USPS will not issue payment until all the necessary documents have been received. In order to ensure prompt payment, employees should submit the appropriate documents as soon as possible.

Differential payments will be made by the same method employees previously received pay from the Postal Service, unless employees request a new method. Payments can either be received as a paper check, direct deposit, or through Postal EASE.

Other Reservist Differential Information

- Differential pay is considered taxable income. Applicable federal and state income taxes will be withheld from the payment.

- Differential payments are not subject to FICA (Social Security and Medicare) taxes if the payments are for active duty periods exceeding 30 days.

- Reservist pay does not end an employee’s military LWOP status.

- The differential scheduled payment date can be no later than eight weeks following the normal USPS salary payment date for a pay period. Employee documentation must be received four weeks prior to this scheduled date, or the payment may be delayed.

Click here for more information about Reservist/National Guard Differential Pay Eligibility for Postal and Federal Employees on Military Active Duty since March 14, 2009.