collapse >>

Search for Articles

APWU Arbitration Award Secures Grievance Rights for Separated Non-Probationary Employees

July 17, 2025

The APWU has secured a major victory for the rights of non-probationary employees who are discharged without just cause from the Postal Service to file grievances on those discharges and have them heard in arbitration, Industrial Relations Director...

WATCH: APWU President Dimondstein on Ratification of 2024-2027 National Agreement

July 12, 2025

APWU President Mark Dimondstein Addresses the membership on the Ratification of the 2024-2027 National Agreement

Dispute Over Reassignment of Non-Bargaining-Unit Employees To Bargaining-Unit Positions Appealed to Arbitration

The Union has appealed to arbitration a dispute over whether the Postal Service violates the collective bargaining agreement when it reassigns non-bargaining-unit employees to bargaining-unit positions in an installation or craft where (1) there is...

Obama Picks Carolyn W. Colvin to Lead Social Security Administration

Late last week, President Obama announced his intent to nominate Carolyn W. Colvin to lead the Social Security Administration (SSA). A longtime government administrator, Ms. Colvin has been the agency’s acting commissioner since February 2013. There...

Safety Hazard on APPS Prime Function May Cause Serious Injury and Loss of Life

APWU members are advised not to use the “prime function” to pre-load belts on APPS (Automated Package Processing System) machines.

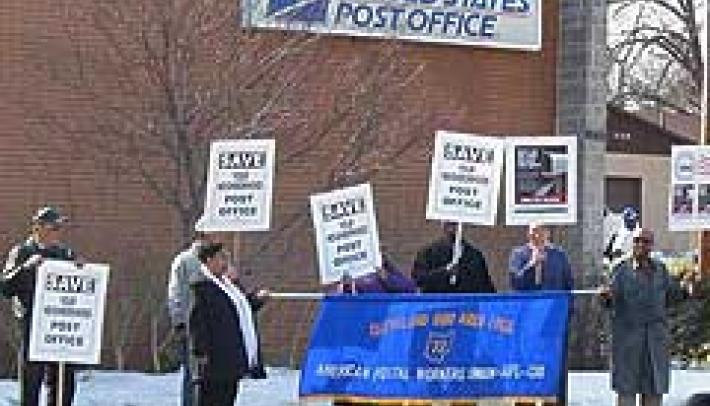

PRC Slams USPS Closure Plans

Echoing recommendations made by the APWU, the Postal Regulatory Commission (PRC) sharply criticized USPS plans for closing stations and branches in an “advisory opinion” issued March 10. The Postal Service should give residents more notice when it...