All News

The Latest from your Union—All in One Place

fighting for justice

The Latest from your Union—All in One Place

fighting for justice

Filters

Filter By

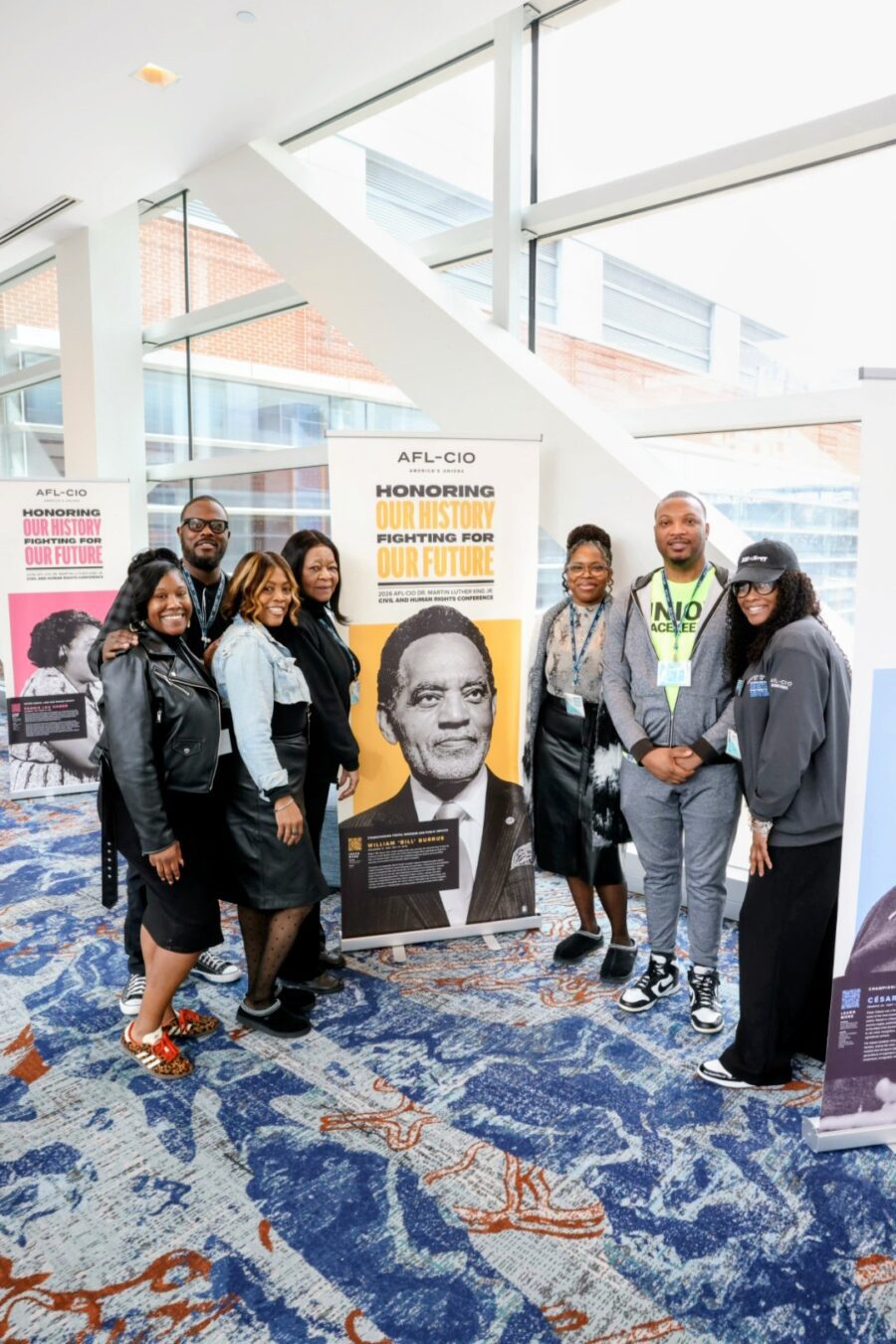

January 20, 2026

APWU attended the 2026 AFL-CIO Martin Luther King Jr. Civil and Human Rights Conference, which took place January 15-18 in Baltimore, MD. APWU President Jonathan Smith, Executive Vice-President Debby Szeredy, Secretary-T...

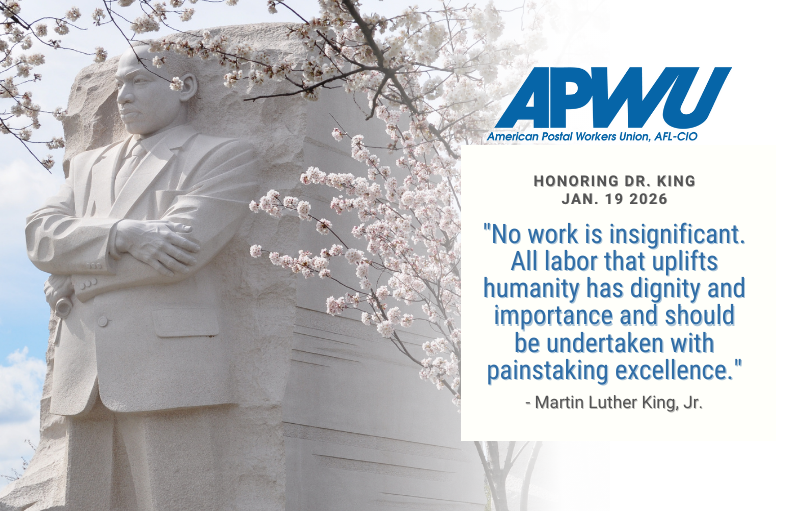

January 19, 2026

January 16, 2026

Research & Education Director Joyce B. Robinson shares guidelines on how to properly write a resolution for submission to official meetings such as the APWU National Convention.

January 16, 2026

Retirees Director Nancy Olumekor explains how postal retirees can rejoin the APWU as a retiree member, and provides advice for current and future retirees.

January 16, 2026

As we approach Tax Season, The A Grand Alliance provides an update on Direct File, the Free Tax Filing System pilot program.

January 16, 2026

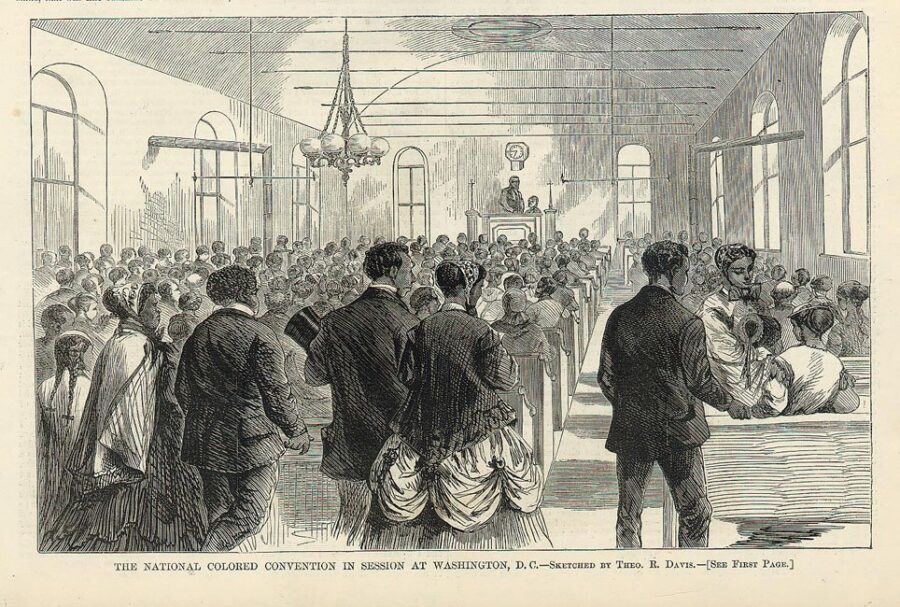

This month in Labor History, we take a look back at Colored National Labor Union (CNLU), the first national union established in 1869 to address black workers’ needs, and the Akron Rubber Workers Strike od 1936 that intr...

January 16, 2026

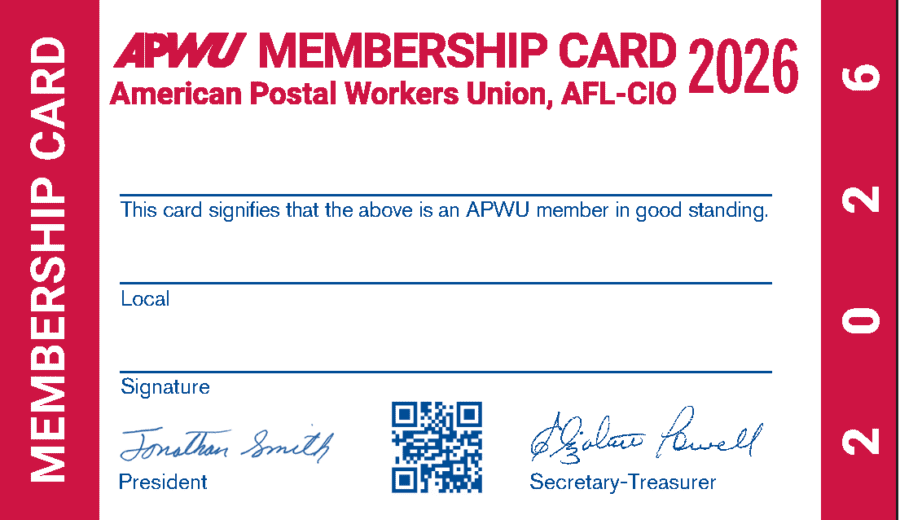

Your membership card represents your connection to a collective force dedicated to protecting postal workers’ rights, benefits, and workplace safety.

January 15, 2026

Support Services Director Kimbery A. Maurer provides a brief history of the Support Services Division and explains the importance of private-sector organizing.

January 15, 2026

“Serving the 40,000-plus members of the Southern Region to improve wages, benefits, safety, and working conditions is a responsibility that I embrace wholeheartedly.“ Newly elected APWU Southern Regional Coordinator Tony...

January 15, 2026

Clerk Craft Director Lamont Brooks discusses three Step-4 disputes regarding Postal Support Employees that were recently resolved: Pretextual Separation Issue, Designation of Hire and Separation/Termination Notifications...

January 15, 2026

It is the policy of APWU that no union representative is authorized by the national union to represent individual bargaining unit members (or other postal workers) in Equal Employment Opportunity (EEO), Merit Systems Pro...

January 15, 2026

Maintenance Craft Director Idowu Balogun provides the latest updates regarding the Per Diem MOU, and the initiation of two new national disputes challenging Field Maintenance Operations and the MS-47 TL-5 handbook.

January 15, 2026

MVS Director Michael Foster explains the Step-4 agreement concerning the Postal Vehicle Service (PVS)’s use of scanners.

January 15, 2026

"The fights we take on affect every postal worker and every community we serve.” APWU Legislative and Political Director Judy Beard reflects on APWU’s victories in 2025 and the battles we still face in the new year.

January 15, 2026

"As we head into another year of opportunity and growth, remember that organizing isn’t a seasonal thing. It’s the heartbeat of our union." Organization Director Anna Smith outlines organizing goals to strengthen trainin...

January 15, 2026

"As we move forward, we must continue to prioritize member education and empowerment." Human Relations Director Daleo Freeman shares goals and priorities for the Human Relations Department in 2026.

January 15, 2026

(This article appeared in the January/February 2026 issue of The American Postal Worker magazine) I would like to welcome our new APWU Health Plan members who enrolled this Open Season. And if you were already a member,...

January 15, 2026

January 13, 2026

"Safety cannot be an afterthought. Safety needs to be at the forefront of all our minds when we work in a dangerous, industrialized environment." Industrial Relations Director Charlie Cash stresses the importance of mana...

January 12, 2026

January 9, 2026

This week’s killing of Renee Nicole Good at the hands of ICE agents in Minneapolis was tragic. It has also laid bare the terror that ICE raids are inflicting upon workers and our communities across the country. In Los An...

January 7, 2026

January 6, 2026

Recent changes to the Postal Service’s Domestic Mail Manual (DMM), which sets out mailing policies and standards, have caused concern regarding postmarking practices. While the USPS has updated the DMM to clarify its pra...

January 5, 2026

January 2, 2026

APWU President Jonathan Smith reminds members that our safety, health and wellbeing matters on and off the job. The APWU continues to fight for safe working conditions, adequate staffing, and respect our members deserve.

January 2, 2026

Executive Vice President Debby Szeredy urges the Postal Service to take meaningful action to address the issue of toxic workplaces.

January 2, 2026

Secretary-Treasurer Elizabeth "Liz" Powell shares important dates, deadlines and tips to prepare for filing annual reports with the Department of Labor.

December 22, 2025

Peak season is the busiest time of year for postal workers across the country. From November through December, and even into the New Year, processing returns, postal workers are working tirelessly to ensure packages, let...

December 19, 2025

December 19, 2025